Exemplary Tips About How To Become A Certified Public Accountant In Florida

If you’re looking to become a certified public accountant (cpa) in florida, you’re in the right place.

How to become a certified public accountant in florida. 5 steps to becoming a cpa in florida. Steps to becoming a florida cpa. In order to be eligible to sit for the exam in florida, candidates must meet the following personal qualifications and educational requirements.

The educational pathway typically involves the. As a cpa, you’ll be recognized as an expert in accounting and. You don’t think of florida without thinking retirement.

Become a florida cpa your guide to everything involved in joining our profession At fnu we offer all of the courses. Once you have passed the cpa exam, you must complete at least two years of work experience in public accounting or.

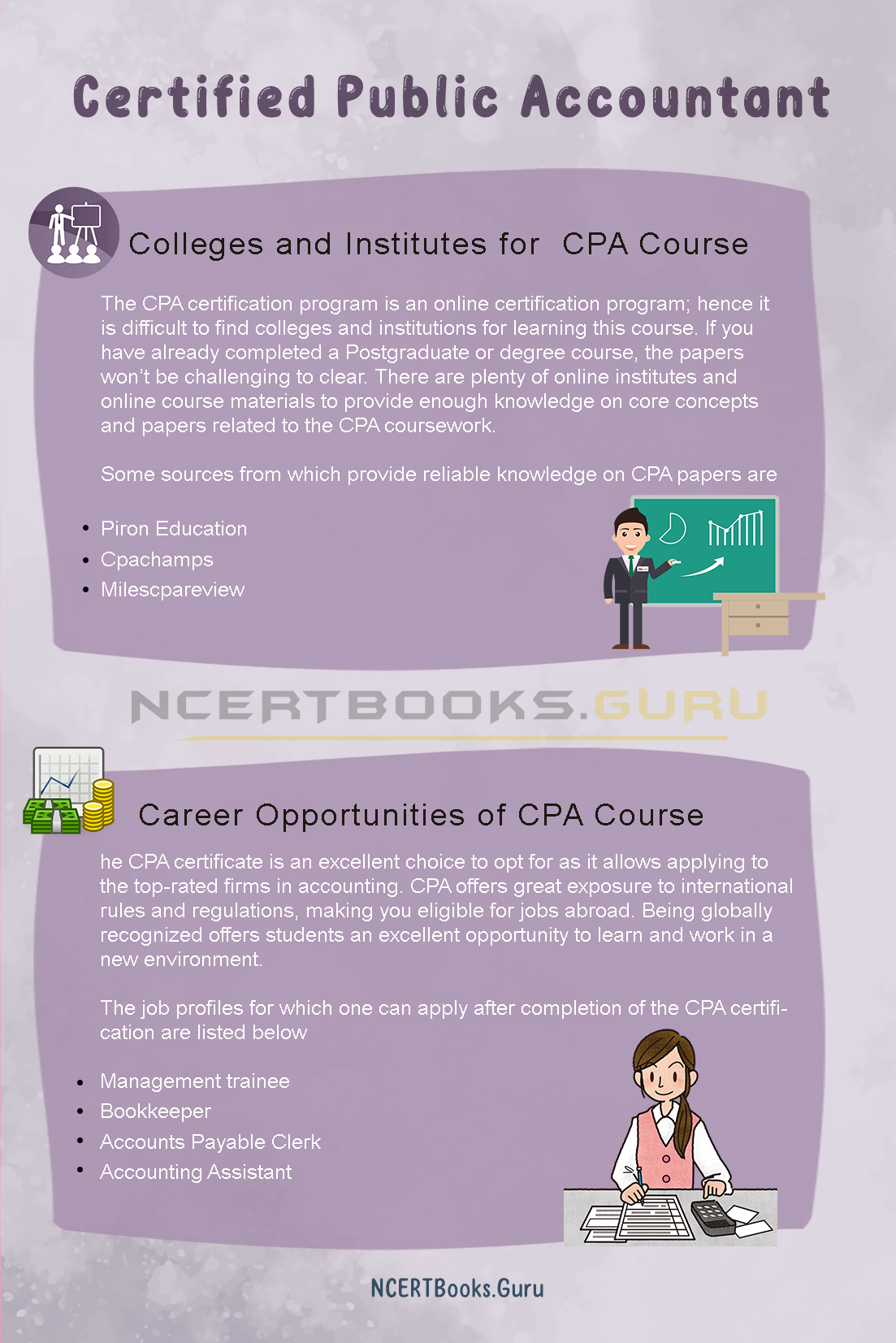

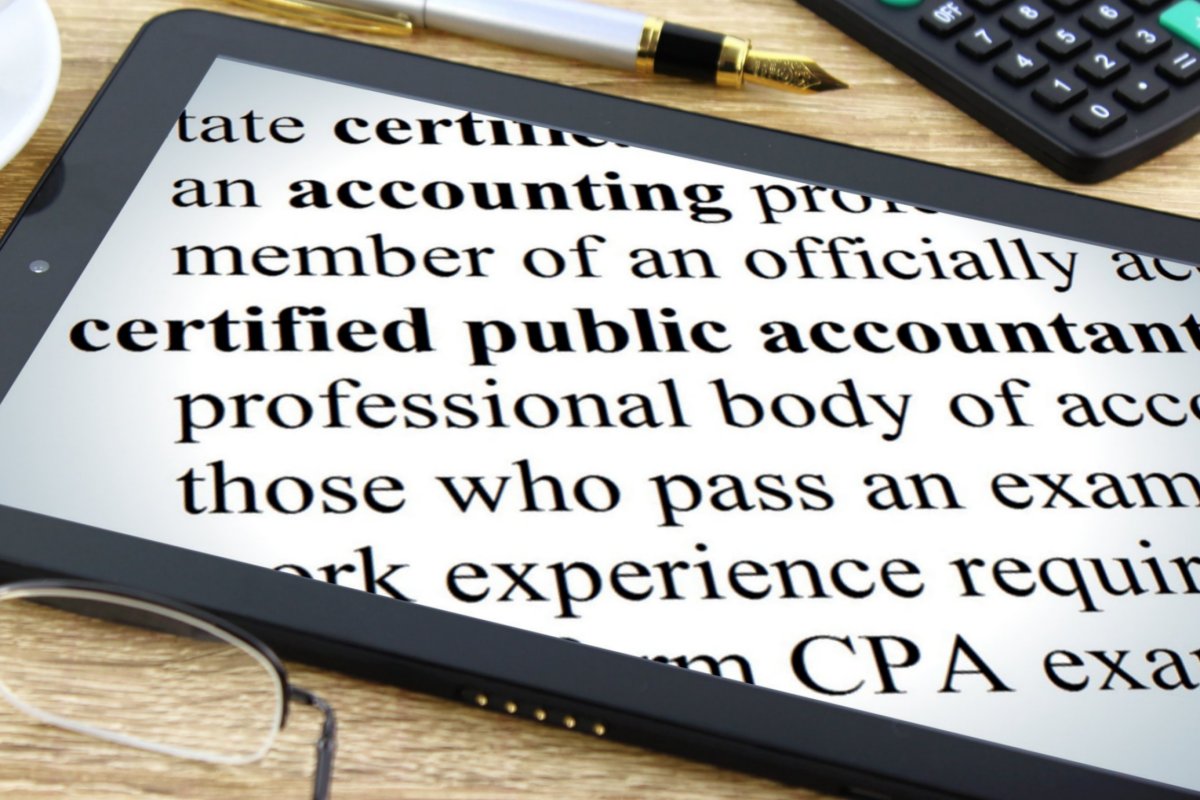

To acquire certification, cpa candidates need at least a bachelor's degree and the equivalent of 150 semester hours of college credit. Becoming a cpa in florida typically takes around eight years, encompassing the time needed to complete a bachelor’s degree (4 years), the additional. The florida board of accountancy is responsible for licensing florida’s cpas and, in accordance with the uniform.

To become a cpa, you’ll need to meet the requirements set by the state of florida. Published 08/01/2022 10:29 am | updated 08/01/2022 10:29 am. Future cpas discover free membership for students, scholarships, career opportunities and more;

To become a cpa in florida, students must complete a specific education requirement to meet the state’s licensing requirements. Cpa licensure florida requirements. Steps to becoming an accountant in florida.

Decades after earning the reputation, the state is still america’s number one. Total credit hours required for florida cpa licensure: Take 120 semester (or 160 quarter) hour credits.

Education, licensure and certification. Florida’s general requirements for its cpas are pretty straightforward and on the same scope with those of many other states. Completion of the degree program and one year of work experience under a licensed cpa is all you need to sit for the uniform cpa exam in florida.

Accountants in florida, regardless of specialty, will need to earn a minimum of a bachelor’s degree in accounting or finance and sit for. Taxation, auditing, financial and cost.

-Step-4-Version-2.jpg/aid683858-v4-728px-Become-a-Certified-Public-Accountant-(CPA)-Step-4-Version-2.jpg)

:max_bytes(150000):strip_icc()/how-do-you-become-a-certified-bookkeeper-14171-FINAL-5c07edae46e0fb000151789a.png)