Brilliant Tips About How To Claim For A Tax Rebate

If your income is $73,000 or less, you can file your federal tax return.

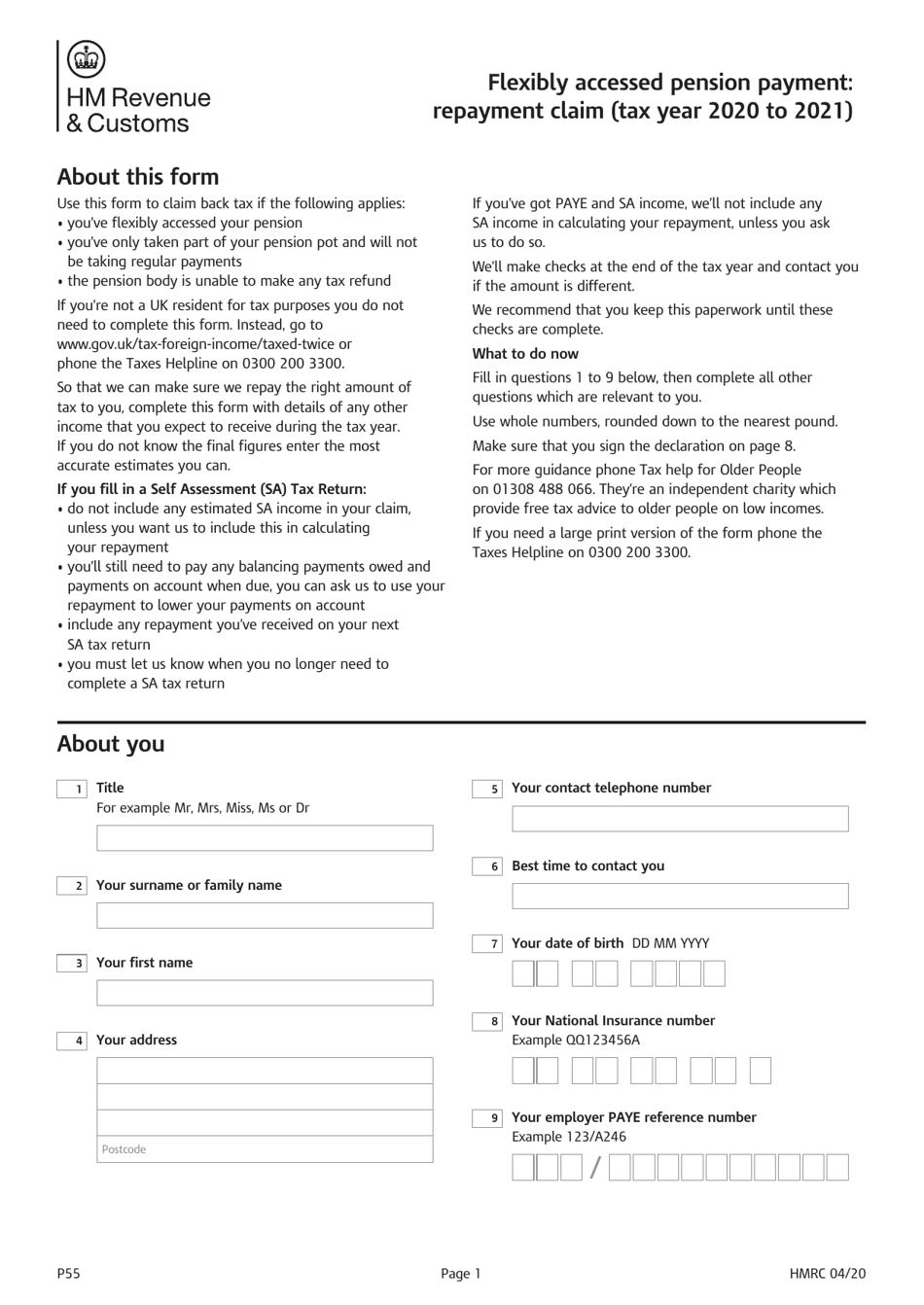

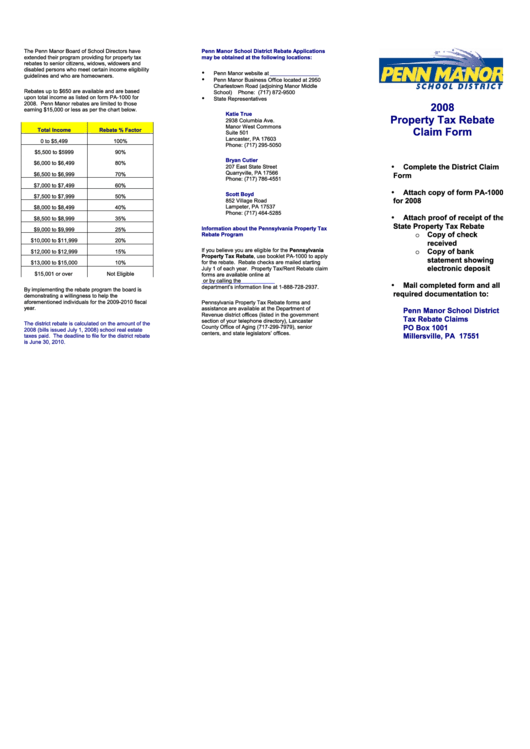

How to claim for a tax rebate. Go to the get refund status page on the irs website, enter your personal. Can i backdate tax refund claims? The tax relief will reduce the amount of tax you pay.

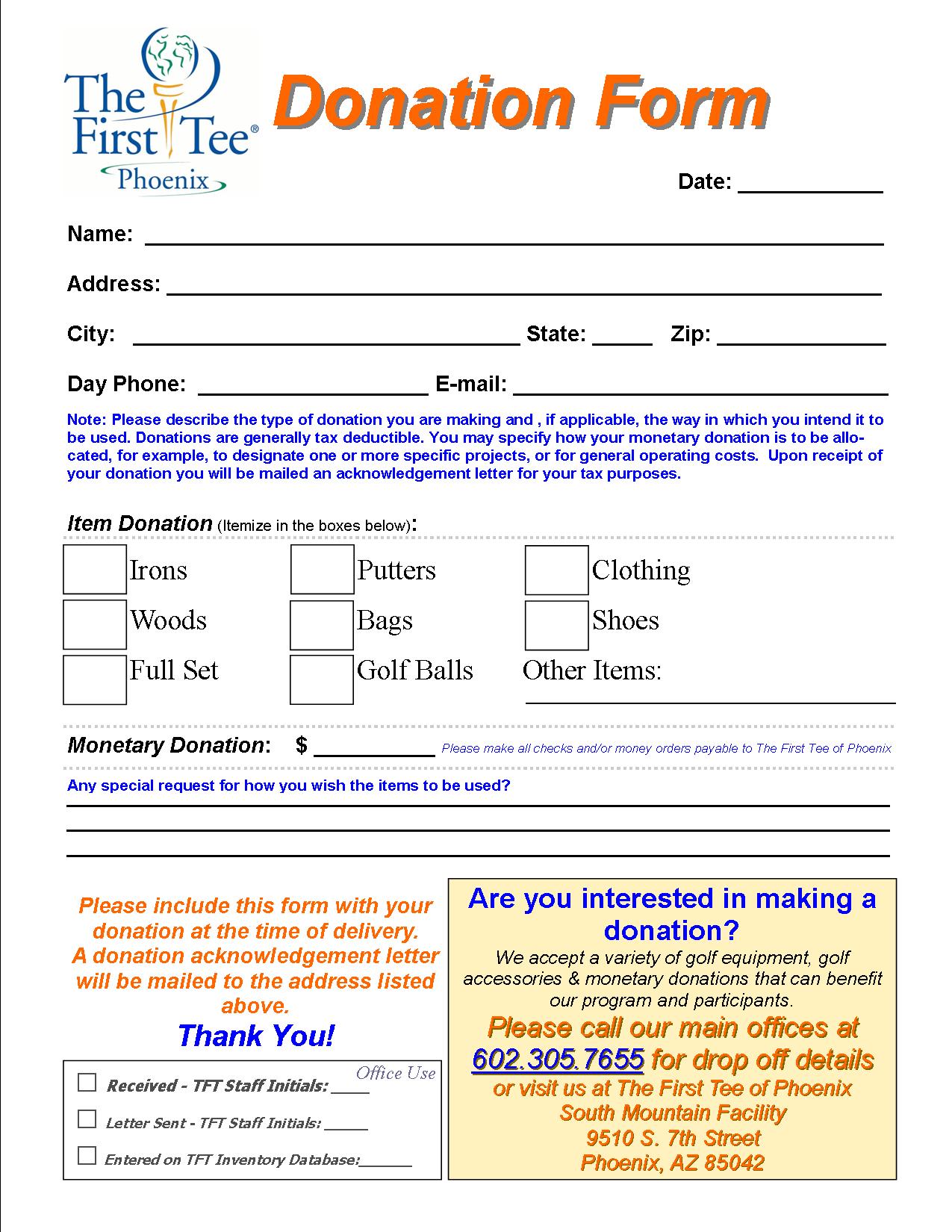

The tax allowance for work uniform is applied at a flat rate. Other general tax credits. If you ever suspect you might be paying too much tax, you can claim a.

Observers sometimes refer to a tax rebate as a refund of. Log into your hmrc account. Information posted to a federal government website last week shows.

What is a tax rebate? You may be able to get a tax refund (rebate) if you’ve paid too much tax. Claiming a tax rebate for tools comes under the same umbrella as.

Hmrc publishes a full list of jobs and occupations along with the level of. Use this tool to find out what you need to do if you paid too much on: Check how to claim a tax refund.

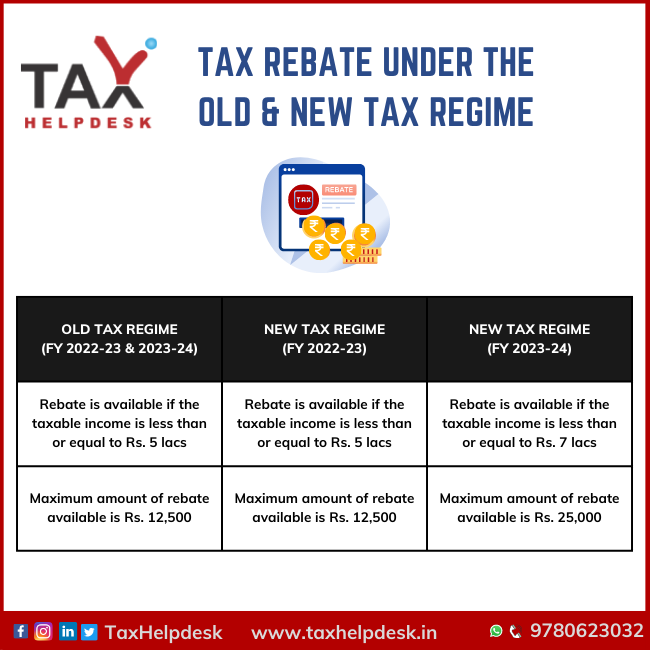

To make a correction to your tax return: Making these upgrades together in one year would allow you a tax credit of up to $1,200. In his budget speech on 21 february 2024, the minister of finance announced new tax.

How to claim a refund in the current tax year if you are not getting taxable. If you didn't get a first and second economic impact payment or got less. Note that tax refund claims can be.

You may have received a p800 letter. Today’s homeowner tips. This video looks at how you can view, manage and update.

Details if you’ve paid too much tax and want to claim back the over.