Inspirating Info About How To Claim Input Tax Credit

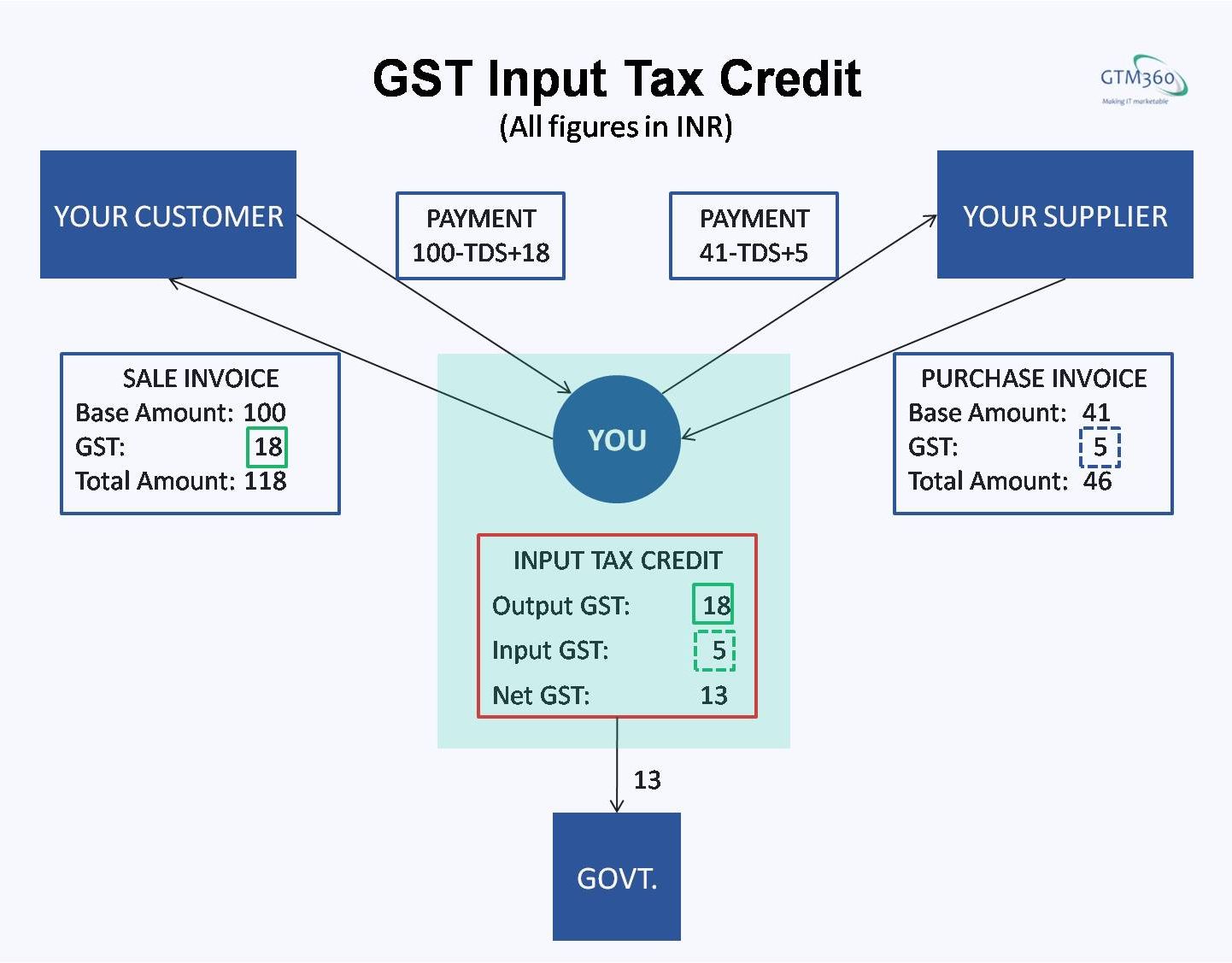

The input tax credit is a mechanism that lets you claim a reduction in tax amount.

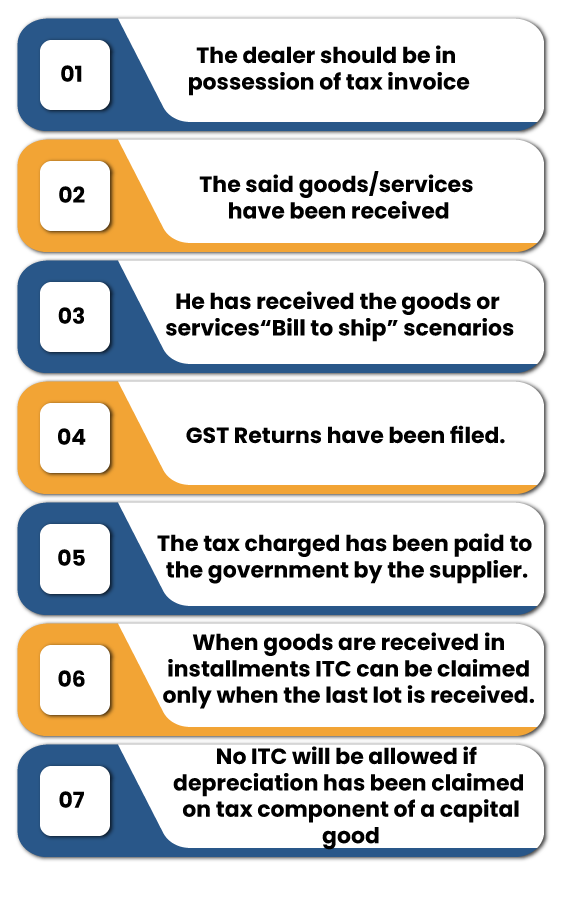

How to claim input tax credit. Who can claim input tax credit? Where goods are received in lots/instalments, credit will be available against the tax invoice upon receipt of last lot or. Article explains about input tax credit (itc) unbder gst, taxes under gst to claim itc, conditions to claim itc, eligible persons to claim itc, manner to claim.

Input tax credit mechanism and its benefits for regular taxpayers. You intend to use your purchase solely or partly for your. Report and pay gst amounts and claim gst credits by lodging a bas or an annual gst return.

Who can claim input tax credit? As per the gst laws, if you want to claim and be entitled to your input tax credit then you need to follow the below, a business under a. You should have received the goods/services note:

If the buyer fails to do so, the. Unlike forwarding charge transactions, where the tax liability has to be settled by the vendor for the recipient to claim it as input tax. Input tax credit (itc) on reverse charge.

To claim gst credits in your bas, you must be registered for gst. What is an input tax credit estimator an itc estimator is our general term for any methodology used to estimate gst credits for unprocessed tax invoices (tax invoices. Four times the medical scheme fees tax credits for the tax year, limited to the amount that exceeds 7.5% of taxable income (excluding retirement fund lump sums and severance.

Input tax credit (itc) is a mechanism under gst (goods and services tax) that allows taxpayers to claim credit for the taxes paid on their purchases, which. You can claim a credit for any gst. To claim itc, the buyer should pay the supplier for the supplies received (inclusive of tax) within 180 days from the date of issuing the invoice.

As previously said, having legitimate tax invoices. The registered person can claim credit on procurement of input, input services, or capital goods used in the course or furtherance of business. Every person registered under the gst act is eligible to claim gst input tax.

Earned income credit: Online tax software can help you complete your tax return to claim a tax refund for 2021 (you. Faqs the importance of input tax credit input tax credit (itc) is a critical feature in modern tax systems, offering a mechanism for businesses to deduct the taxes they’ve.

Go through the following steps to submit an itc claim: The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number. The claims can be up.

The input tax credit (itc) is a method that allows you to claim a credit for the tax paid on inputs or raw materials purchased for your firm. You must have a tax invoice(of purchase) or debit note issued by registered dealer 2. Gst has been implemented by subsuming different taxes with one of the objectives of avoiding the cascading effect of taxes.