Perfect Info About How To Claim Stimulus Package Money

If you use cnet's first stimulus check calculator or second payment calculator and find you may have qualified for a larger stimulus payment than you.

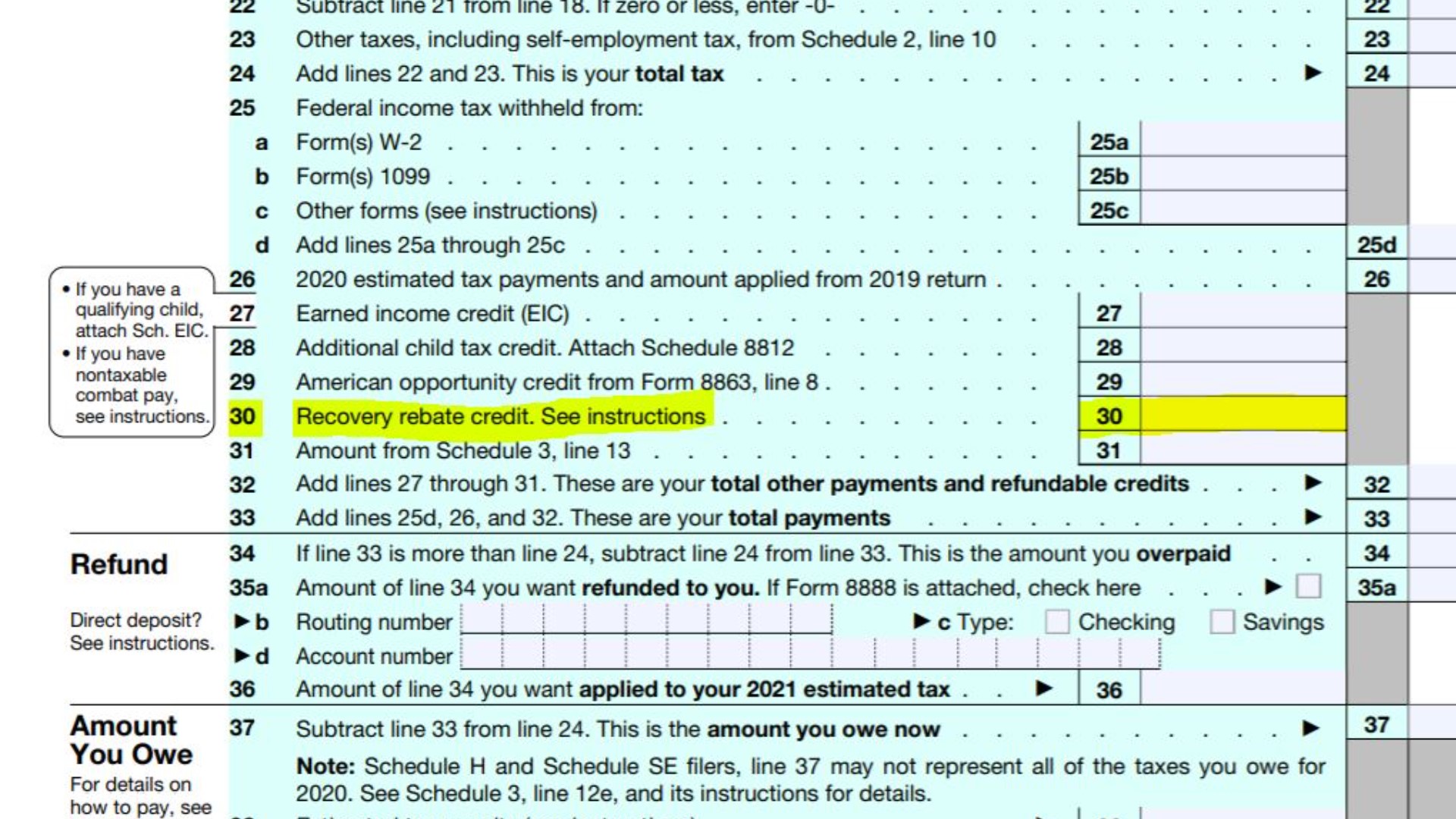

How to claim stimulus package money. Furthermore, if you didn’t file taxes for 2020 and missed out on the first and second stimulus checks of $1,200 and $600, respectively, you can claim a recovery. Were you eligible to receive an economic impact payment in 2020, but never received it? How do i know if i will get the full amount?

With the recent passing of the third stimulus payment, you’ll be asked to enter both. Single adults with social security numbers who. It said that people who either missed a payment or didn't receive the correct amount will need to wait until they file their 2020 tax returns to claim the extra money.

When filing with taxact, you will be asked to enter the amount of your stimulus payment. If you lost your stimulus check or suspect it was stolen, you can request the irs to trace your payment and get the amount automatically reimbursed to you as a tax. The vast majority of those eligible for economic impact payments related to coronavirus tax relief have already received them or claimed them through the.

For the tax year 2023, it would increase to $1,800; Filing electronically can guide you through the form. The stimulus money promised under the american rescue plan began to hit the bank accounts of many americans on wednesday, march 17 — the first official.

For instance, if one parent claimed a child in 2020 and received a stimulus payment last year, the second parent may be able to claim the child on their 2021 return. To get your money, you’ll need to claim the 2021 recovery rebate credit on your 2021 return. You may be able to use a.

It depends on your income. You can find information about claiming the 2020 recovery rebate credit with your tax. How to claim a missing payment you may be eligible to claim a recovery rebate credit on your 2020 or 2021 federal tax return if you didn't get an economic.

The new rules would increase the maximum refundable amount from $1,600 per child. Most eligible people already received their economic impact payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a recovery rebate credit for tax year 2020 or 2021.

For the tax year 2024, to. Lorie konish share key points as new $1,400 stimulus checks go out, some may be wondering why they haven’t received their $1,200 or $600 checks. Single people making less than $75,000, heads of household making less than $112,500, and married couples filing jointly making less than $150,000 qualify for stimulus checks.