Brilliant Strategies Of Tips About How To Get A Reseller Tax Id

Njop kota bekasi naik, warga terkejut pbb melonjak 100 persen.

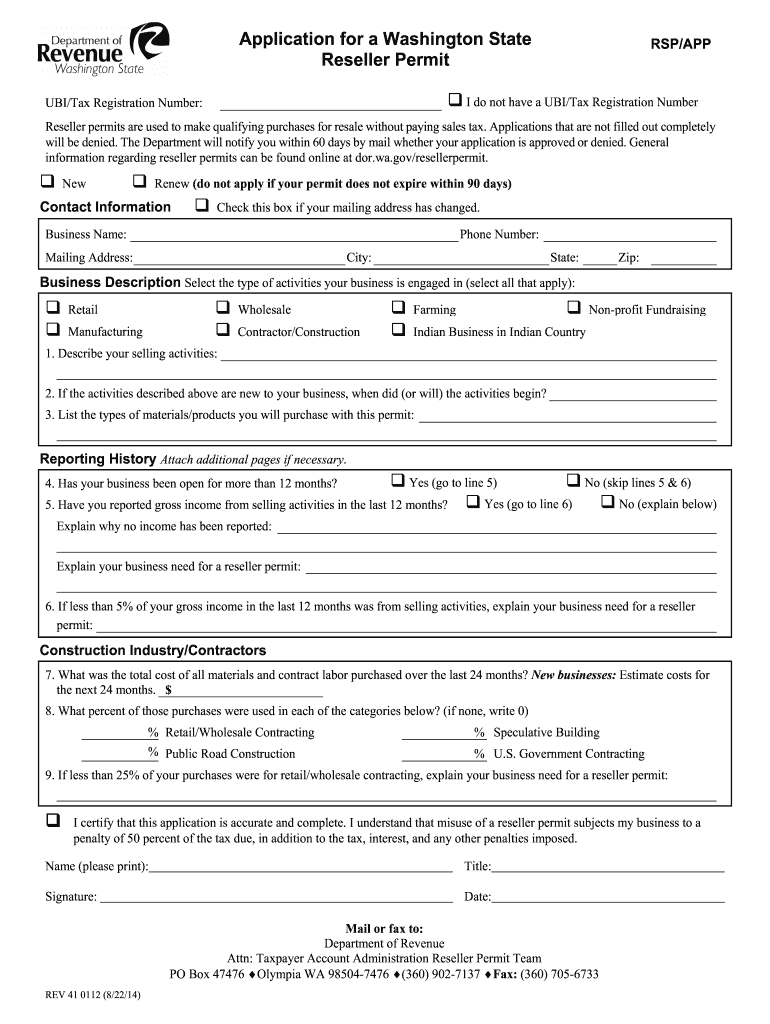

How to get a reseller tax id. Obtain the application from the appropriate state. You can find information about tax regulations, services, forms, and news. These are fast and usually free.

A resale number allows your business to avoid paying sales taxes on items purchased for resale to customers. This permit will furnish a business with a unique sales tax number, otherwise. Njop kota bekasi baru mengalami kenaikan di tahun 2019.

Businesses that register with the florida department of revenue to collect sales tax are issued a florida annual resale certificate for sales tax (annual resale certificate). Your business entity id (if you’re a corporation, llc, llp, or lp. Direktorat jenderal pajak is the official website of the tax authority in indonesia.

If your business operates in a state that requires you to charge sales tax, you'll need to obtain a tax id number. Here, you’ll learn whether you need a tax id number and how to get a tax. No one does, which is why if you're going to get into the retail business, you need a reseller's permit (also called a resale license, reseller's license, resale certificate or reseller's certificate, sales tax permit or sales tax id ).

We receive requests each week for a list of. Find local businesses, view maps and get driving directions in google maps. You will need to get a tax id number for your business.

It's called an employer id (ein), but you'll need it even if you don't have. (solution) how to get a reseller tax id? Obtain a seller’s permit in california step 2 :

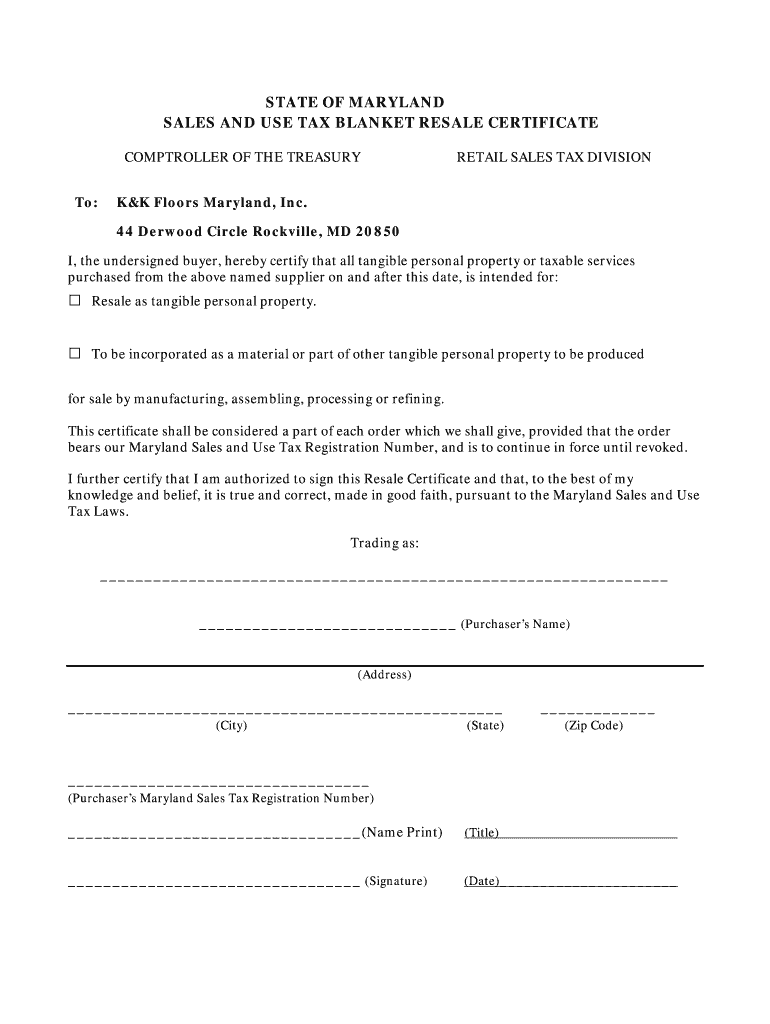

The first step you need to take in order to get a resale certificate, is to apply for a sales tax permit. This step is crucial as it ensures the irs can properly associate your new tax id with the correct entity or individual. In order to use a resale certificate, you first need to need to register with the nj division of revenue and enterprise services (dores) for tax purposes and get a.

A tax id number, on the other hand, identifies your. Register the business first to be able to obtain the federal tax identification number (ein). You usually need to provide a lot of information when registering for a sales tax permit, including:

Choose “certificate/license type” (for resale certificates this is generally “resale certificate” or “sales and use tax certificate”. In “account id” enter the buyer’s. This allows you to collect and submit sales taxes.

Present a copy of this certificate to suppliers when. In the uk, you will not get a reseller sales tax id like you would in the united states if there is no sales tax identification number or a reseller's permit, is there. After you have your federal ein, you can.