Have A Info About How To Get Out Of Paying Pmi

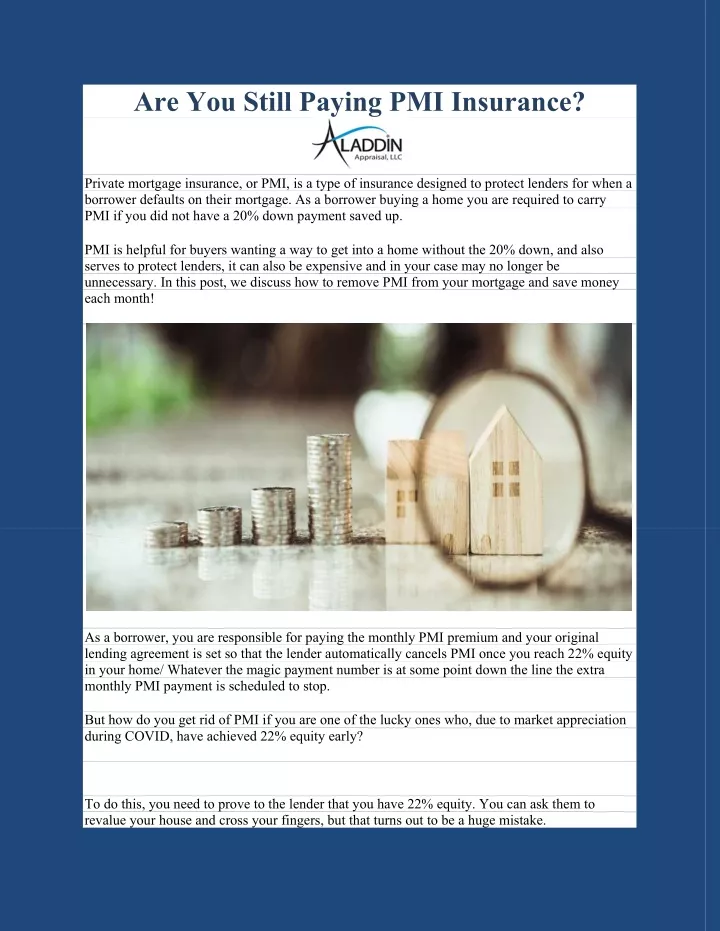

Key takeaways private mortgage insurance (pmi) is incurred if you need to finance more than 80% of the purchase price of a home.

How to get out of paying pmi. It can also be a tool for getting rid of pmi. There's an issue and the page could not be loaded. You can avoid pmi by.

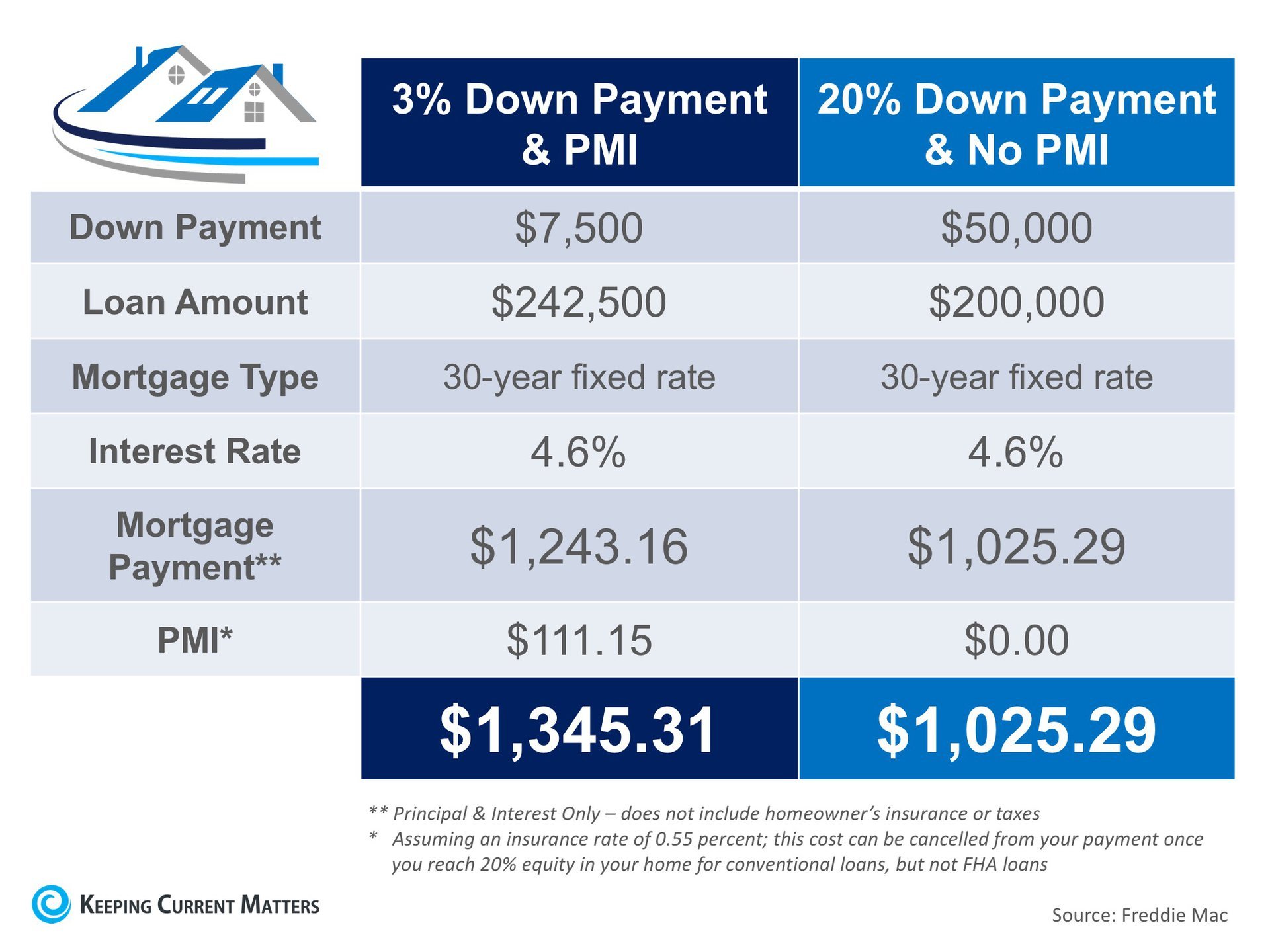

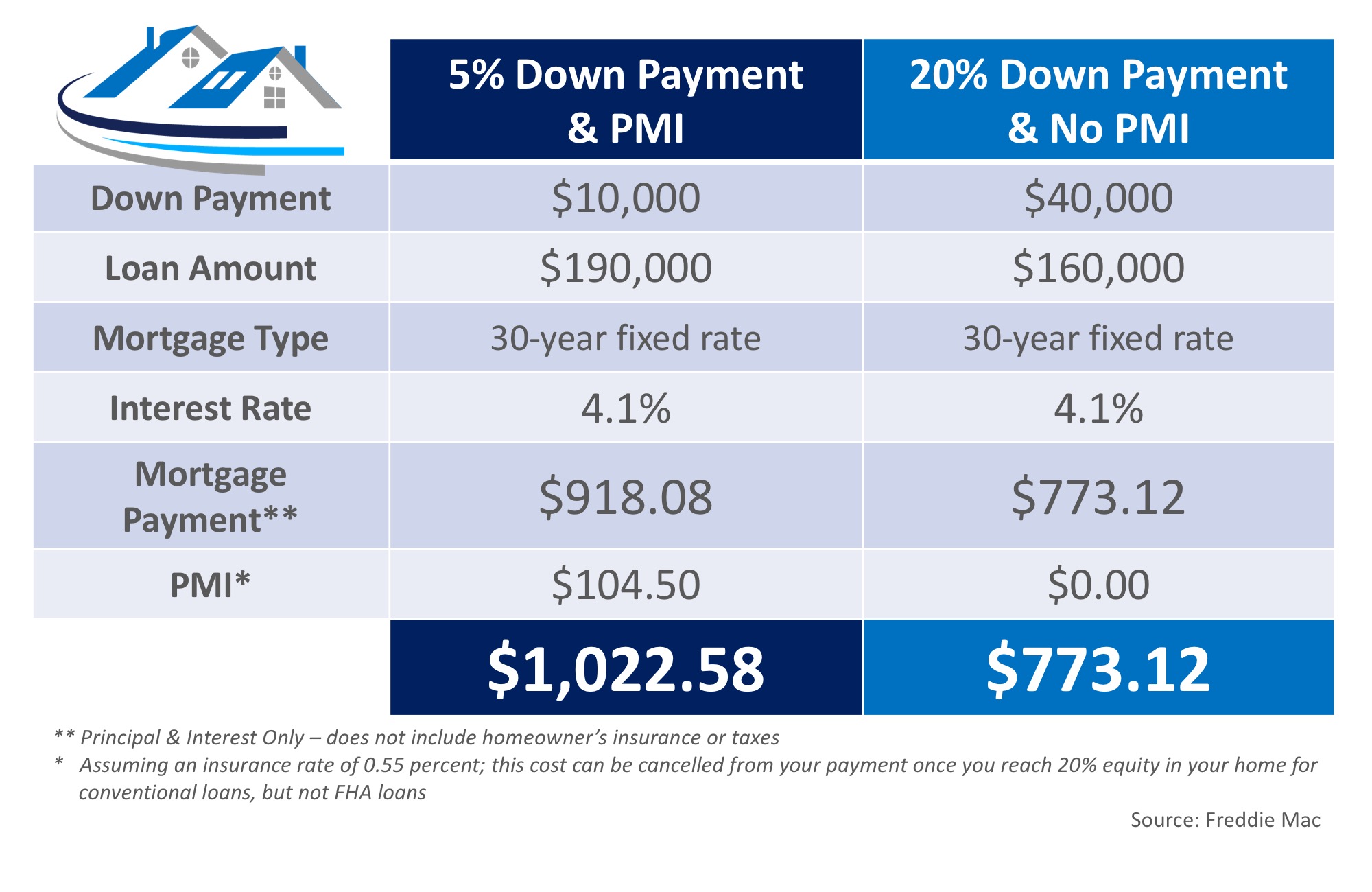

If they used a payment app or online marketplace and received over $20,000 from over 200 transactions, the payment app or online marketplace is required. For example, if you can only afford. You can avoid paying for private mortgage insurance, or pmi, by making at least a 20% down payment on a conventional home loan.

3 ways to get rid of your pmi 1. If you have the resources, you can make a lump sum principal payment to get to 20% equity and request pmi cancellation from there. Fortunately, there are ways to make a down payment of less than 20% without paying pmi premiums on your monthly mortgage payment.

Piggyback mortgage another way to avoid pmi is by taking out a piggyback mortgage to start off with 20% equity in your home. Private mortgage insurance (pmi) is an insurance policy that you pay when you take out a mortgage loan without committing to at least the 20% down payment. The primary way is to reach 20% home equity.

It works in a few ways: Pmi is usually required if your down payment is less than 20% on a conventional loan. Pmi is a type of insurance that may be required for conventional mortgage loan borrowers when they buy a home and make a down payment of less than 20% of.

According to the education department, 4.3 million people enrolled in the. Even if borrowers’ monthly payment is $0, they will still get credit toward forgiveness. Some or all of the mortgage.

The ascent mortgages & home buying how to get rid of pmi updated april 18, 2023 by: Page couldn't load • instagram. Private mortgage insurance, or pmi, protects the lender in case you default.

There are four main ways to get out of paying pmi. This can be done in a few ways but is usually done by paying. The ascent staff our mortgages experts many or all of the products here.

/GettyImages-171324885-e9130cbbd78f43ea9e06449648a95a94.jpg)