Recommendation Tips About How To Get Rid Of Inquiries On Credit Report

A successful dispute will get it removed from your credit report.

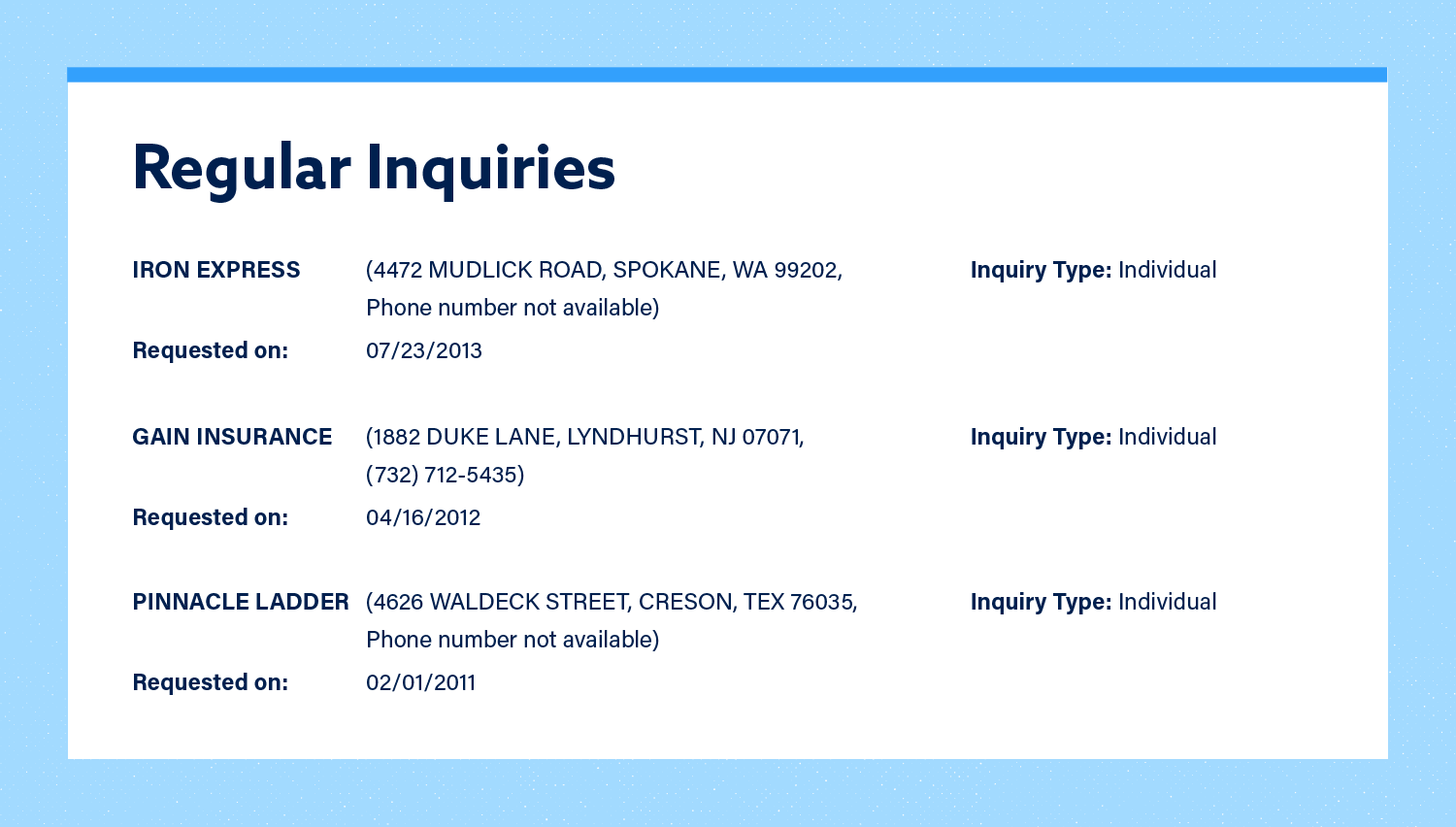

How to get rid of inquiries on credit report. Since you receive three different credit reports, you’ll need to dispute the inquiry with each corresponding bureau. Send a letter or call their customer service. Another option is to contact the creditor directly and request that they remove hard inquiries from your credit report.

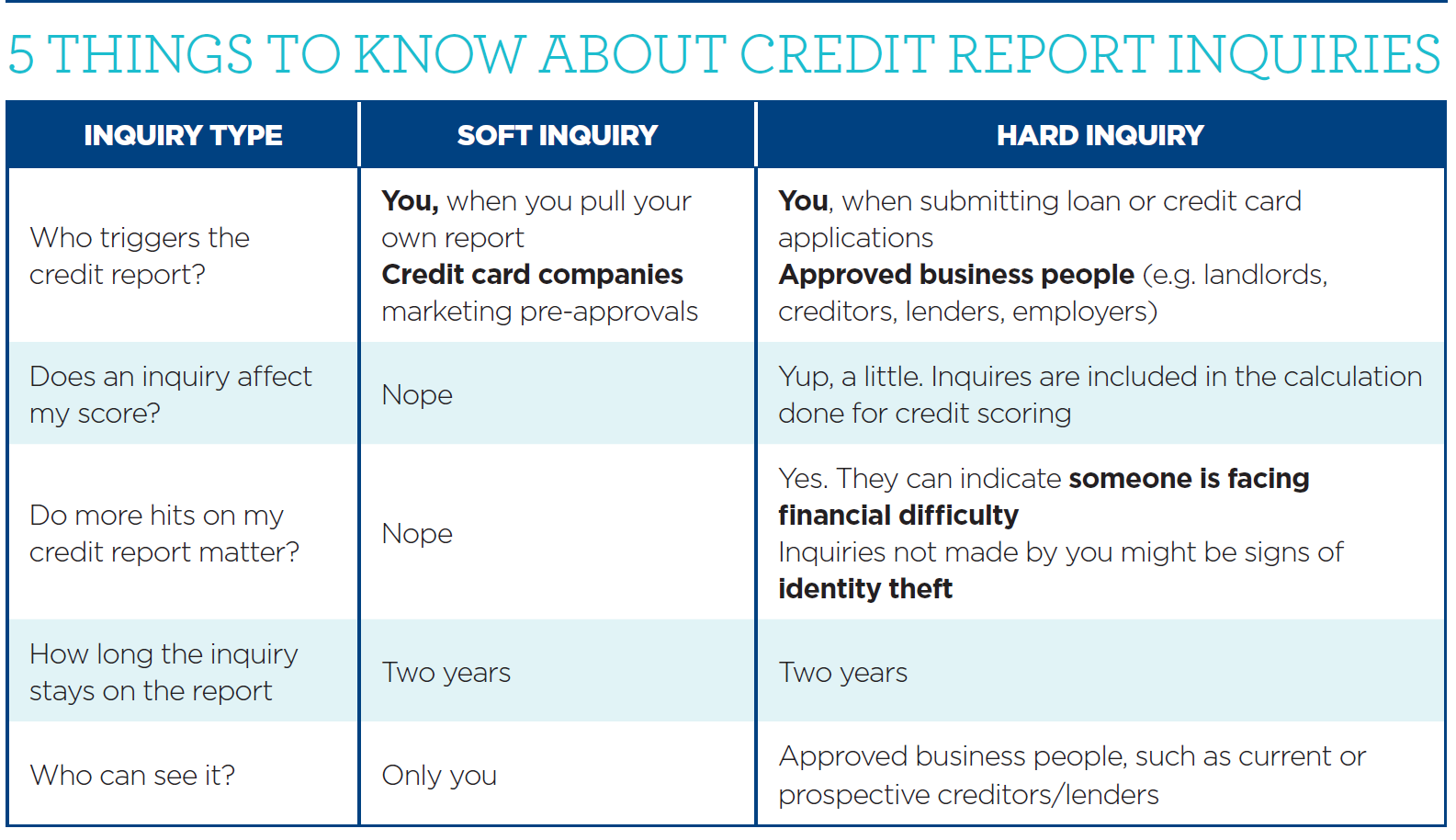

If the inquiry resulted from identity theft, you can have it removed by providing the necessary documentation and filing a police report. Fortunately for you, there are simple steps you can. A hard inquiry occurs when someone you’re planning on doing business with, such as a lender, checks your credit report.

A soft credit pull can give you an idea of what your rate will be without actually. I take you step by step on how to remove inquiries from your credit report. To remove hard inquiries from your credit report, you’ll first need to get your credit report for the three major credit bureaus:

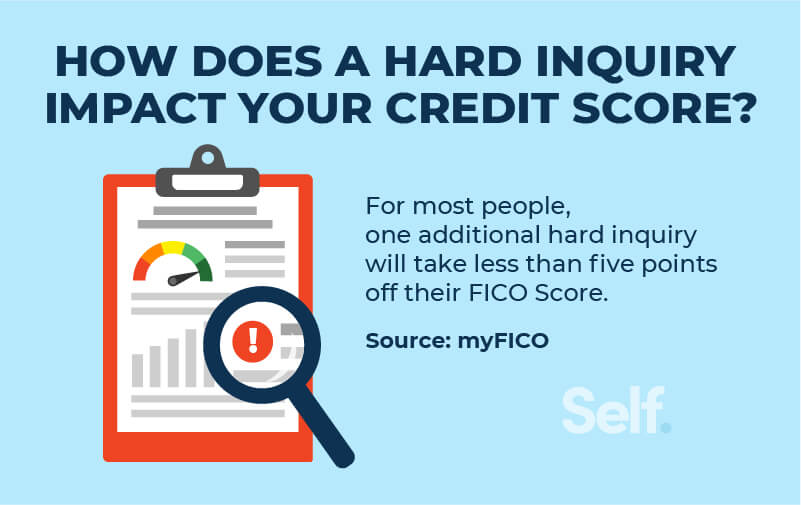

Hard inquiries can ding your credit score by up to five points. If you have not reviewed your credit report, you can get a free one from annualcreditreport.com. They do this to understand the risk you pose as a potential borrower and how you’ve managed past debt obligations.

As a consumer, you have the right to send a. You may be able to get a credit bureau to remove them by following these steps. Dispute with credit reporting agencies.

Do you have unauthorized inquiries on your credit report?

![[Get 44+] Sample Letter For Hard Inquiry Removal](https://upgradedpoints.com/wp-content/uploads/2018/05/Credit-Basics_-How-to-Remove-Credit-Inquiries-From-Your-Credit-Report.png)