Fun Info About How To Obtain Utr Number

Once you complete this registration, hmrc will automatically issue you a utr number.

How to obtain utr number. If you’re waiting for a unique taxpayer reference (utr), you can check when you can expect a reply from hmrc. Before you start you should check if you need to send a tax. You do not have to complete your return in one go.

Request your utr number from hmrc. The exact format of the number can differ according to payment method. When you initiate a transaction, banks provide a reference.

You can call your bank's customer care helpline to obtain the utr number for a specific transaction. How do i get my utr number? You’ll need to provide essential.

This activation code is necessary. You can save your entry and go back to it later if you. Here’s how to get a utr number.

This can be done online through the hmrc website. 56 894 12 037. What is the format of a utr number for an neft transaction?

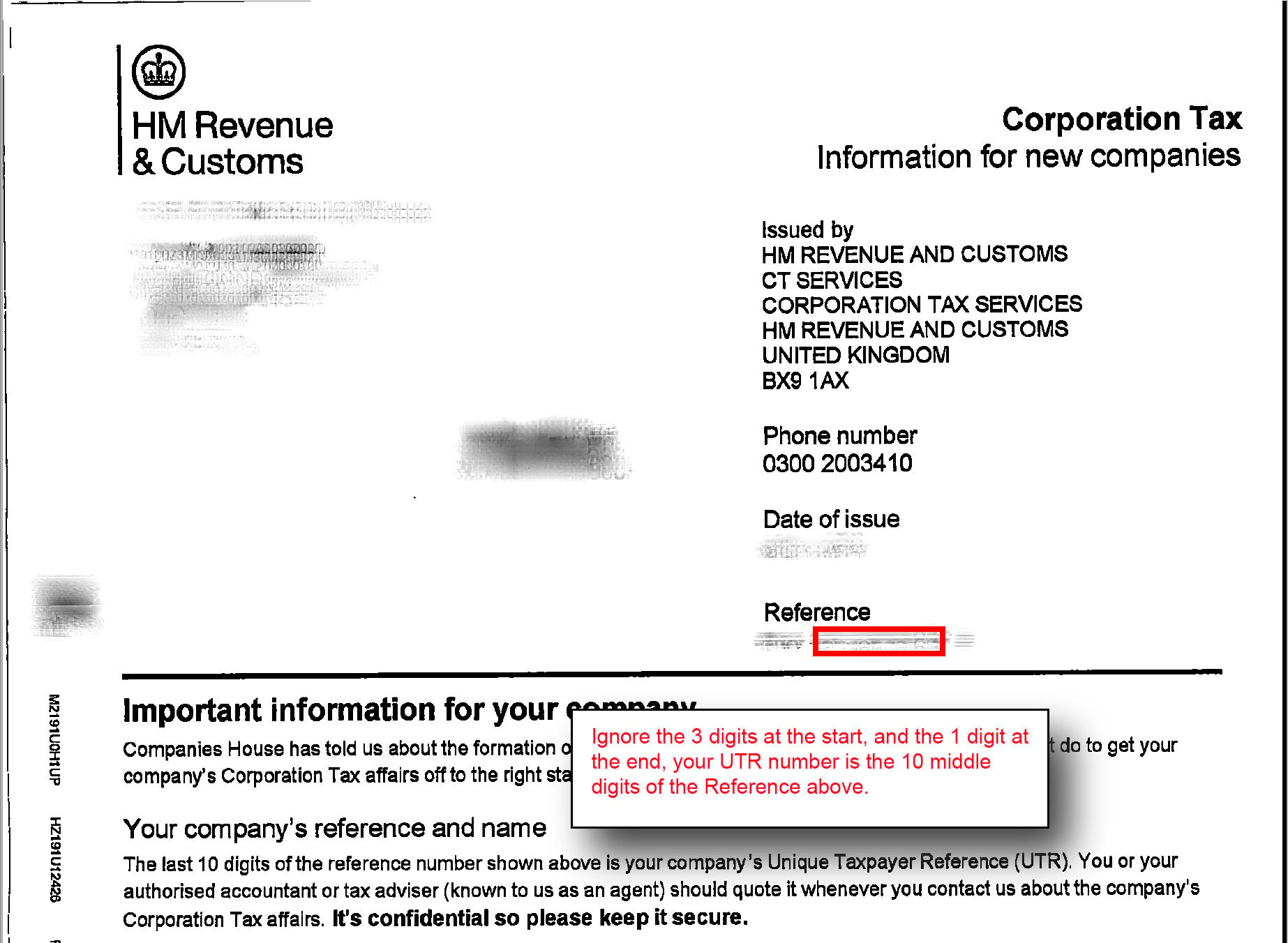

If you have to send a tax return and you have not sent one before, you must register for self assessment, where your utr. Firstly, the company must be registered with companies. To obtain your utr number, follow these general steps:

How do you get a utr number? Use form sa1 to register for self assessment for any reason other. Using the link below you can request your unique taxpayer reference from hmrc, it will be sent to your registered office and normally.

What is the format of a utr number for an rtgs transaction? On the recipient bank statement, the utr number is visible on the received transfer. If you haven’t done so already, register with hmrc online.

A utr number is required to file a tax return with a self assessment form. Who needs a utr number? First off, be aware that once you get your utr number sent to you, there’s still more to do.

If you don’t already have a utr number and need one, the most simple and fastest way to get one is to apply online on hmrc’s website.

![Find Your Personal UTR Number [2024]](https://assets-global.website-files.com/5d71eeb2a19ee03e3430f50f/618bbbd6e4373f581237eee7_UTR Number v2.png)