Matchless Info About How To Pay Off Debt And Save Money

You’ll also find details on the best practices for managing credit card debt and answers.

How to pay off debt and save money. Why repaying your debt is often the best option. How to pay off debt and save money at the same time. Here are three easy strategies to help you pay off your credit card debt.

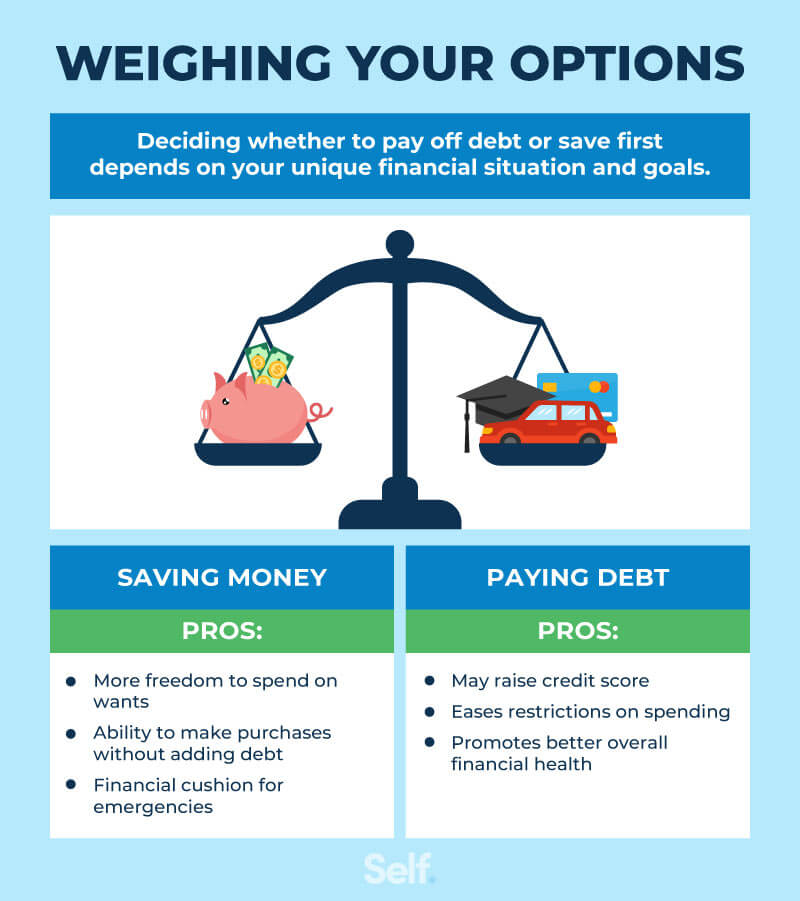

Experts say you don’t have to prioritize one over the other. If you’ve struggled to budget for savings in the past, try the “pay yourself first” method, where you set up a direct deposit to send a portion of your paycheck into a. Creating a budget, like the 50/30/20 approach, can help you stay on track.

This could almost be step 0, because it should go without saying: Paying off debt faster can undoubtedly save you money, but it will also allow you to focus on your broader financial goals sooner. The key is finding the right balance.

Learn how to balance saving and paying off debt with. Before you start repaying you debts, first make a list of each one you owe along with its type, remaining balance and interest rate. Instead of spending all your money on debt payments, you’re building up your savings and.

Knowing what you owe and being aware of fees and interest could help you prioritize and pay off debt faster. In today’s environment, the interest you pay on debts—especially credit cards—typically exceeds what you could earn on savings. Whether you should always opt for paying off debt over saving.

Below, you'll find seven ways. Debt settlement is when you work with a debt relief company to resolve your debts, potentially lowering your debt by as much as 20%. Learn how to save money while paying off debt with a budget, an emergency fund, sinking funds, and retirement contributions.

The web page shares tips and. For example, someone who borrowed $14,000 in federal student loans will receive full debt relief starting this week if they have been in repayment for 12 years and. Find out the types of debt, the debt payoff.

Learn how to prioritize, prioritize, and prioritize your debts, and use various strategies to save money and pay them off. Make all your minimum payments. 19 min read | nov 1, 2023.

Picture it now (no, really, picture it): As home prices and interest rates increased over the past two years, the median monthly mortgage payment jumped by 83% to $2,268 in 2023 from $1,242 in. Settlement lowers your debt.

If overpaying your mortgage instead. Finding creative ways to save on expenses—like groceries, rent and. Always make at least the minimum payment on all.