Awesome Tips About How To Sell Corporate Bonds

By following the steps outlined in this.

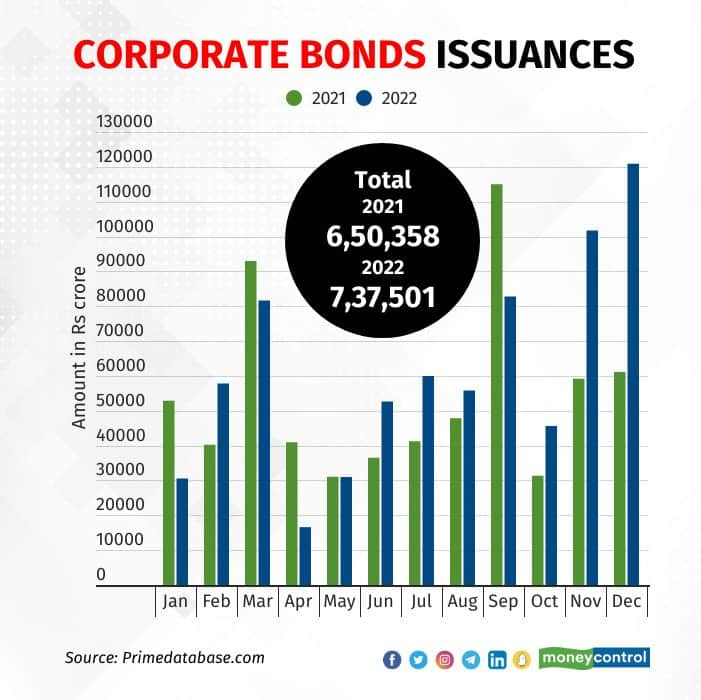

How to sell corporate bonds. Investors can buy and sell corporate. India's vadodara municipal corp plans to raise 1 billion rupees ($12.1 million) through the sale of its maiden green bonds, two merchant bankers said on tuesday.the. A corporate bond is a loan to a company.

Corporate bonds are debt securities issued by corporations to raise capital. Investing how to invest in corporate bonds by marc davis updated july 09, 2023 reviewed by cierra murry when investors buy a bond, they essentially lend. Choose the bonds you want to sell.

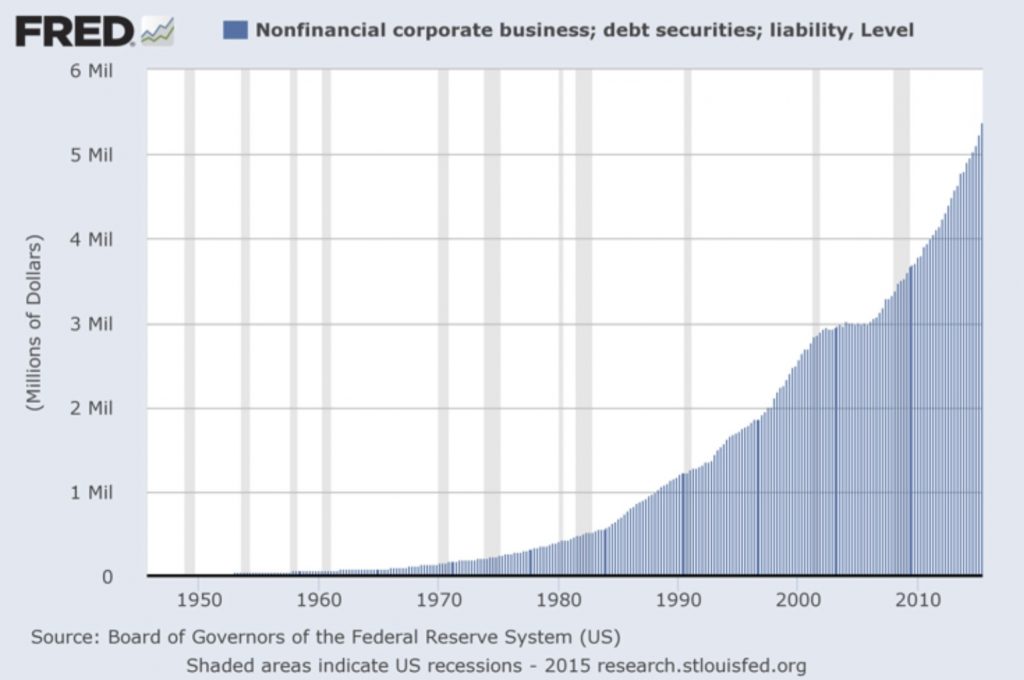

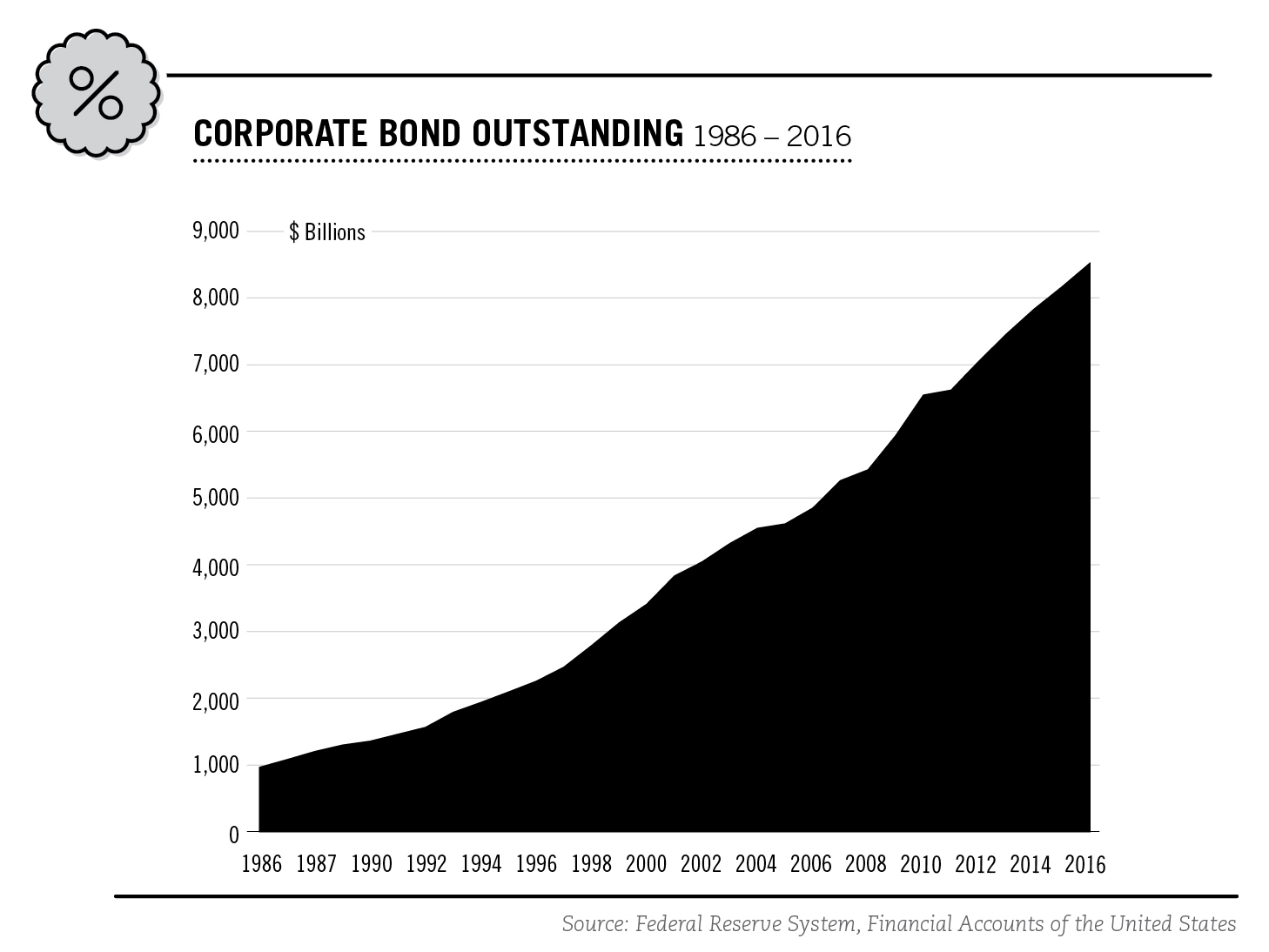

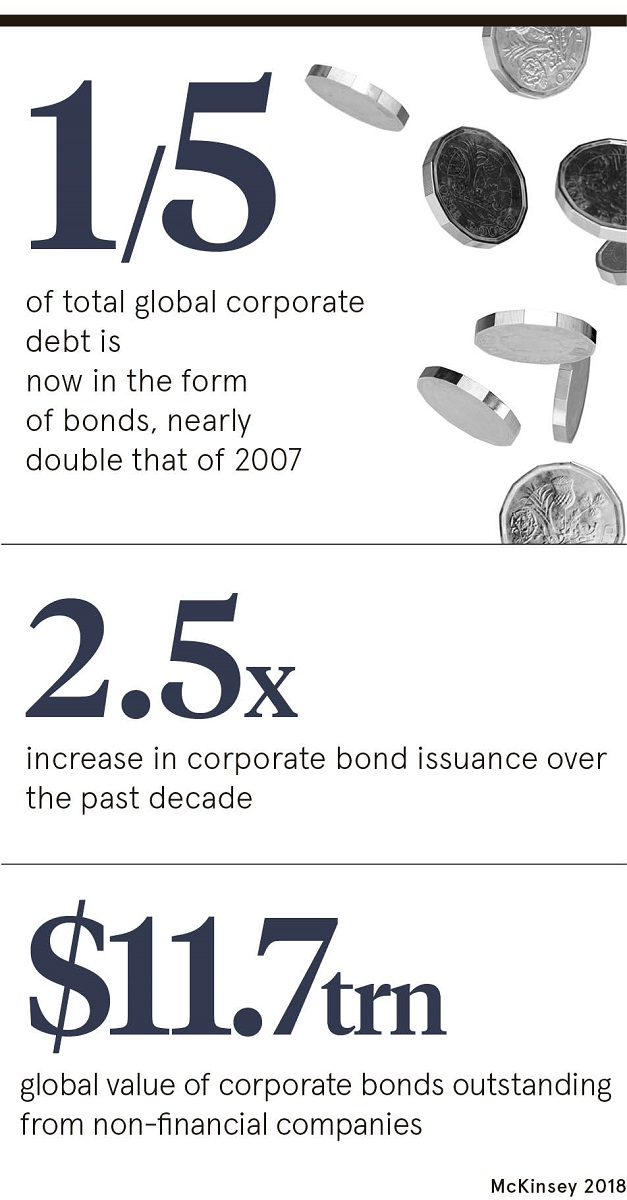

The large market size for outstanding. Direct purchases of corporate bonds are not the only way to invest in them. Selling bonds requires a thorough understanding of the market, bond characteristics, and effective sales strategies.

Mon, february 26, 2024, 3:15 pm pst · 2 min read. Open an account reasons to consider corporate bonds range of choice new issues through corporatenotes program sm find corporate bonds find bonds types. Across different parts of the bondsavvy site,.

Us corporate bond sales hit $153 billion in february record. The initial prospectus for a corporate bond issuance must be a publicly distributed prospectus. To summarize, here are the key takeaways:

Decide if you want to place a limit order, where you specify the price you want, or a market order, where you accept the. Selling bonds as an agent. But they can be complicated.

In rare cases, we may hold corporate bonds to maturity, but, generally speaking, we recommend selling bonds before maturity to lock in capital appreciation. Investors receive interest until the bond matures and the principal is repaid. A bond is a debt security that functions much like an iou.

Governments and companies issue bonds as a way to raise capital. Buying bonds through the public offering means buying the bonds directly from the company, whereas buying the bonds through the secondary market means. Learning about how to buy and sell a bond is just as important as why to.

Investors who hold a bond to maturity (when it becomes due) get back the face value or par value of the bond. 1 write a publicly distributed prospectus. Bonds help add diversity to your portfolio and control risk.

That is, it must be. Contrary to what everyone has told you, individual investors can sell corporate bonds at a fair price.

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)